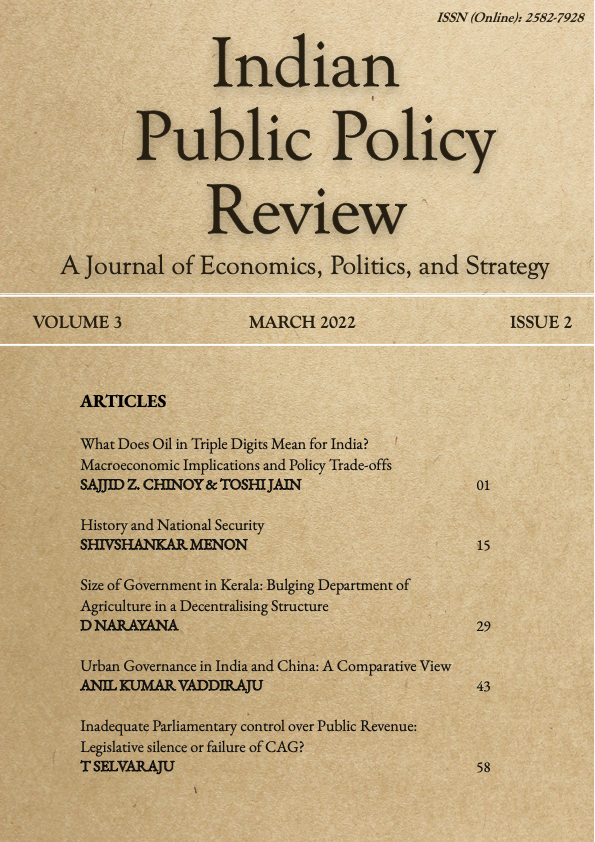

What Does Oil in Triple Digits Mean for India?

Macroeconomic Implications and Policy Trade-offs

DOI:

https://doi.org/10.55763/ippr.2022.03.02.001Abstract

The Russia-Ukraine conflict is expected to impact India’s economy through several channels but we posit first order impacts will emanate from higher crude prices. If crude prices were to average $100/barrel in 2022, they will constitute a discernible adverse terms of trade shock for India’s economy that could shave a percentage point off India’s growth, pressure inflation further and widen the current account deficit towards 3% of GDP. How should policy respond? A negative terms of trade shock would argue for a more depreciated equilibrium real effective exchange rate. Policymakers should let this adjustment gradually take place to enable the corresponding “expenditure switching” needed to bring external imbalances back to sustainable levels. A sustained supply shock will make the trade-off for monetary policy more acute, with downside risks to growth accompanied by upside risks to inflation expectations. While the 2022-23 Budget created buffers to protect against shocks, fiscal policy will face its own set of trade-offs in simultaneously attempting to accommodate the shock, support growth and preserve macroeconomic stability. Beyond the near term, policymakers must consider systematically hedging crude price imports in global markets to protect the economy from periods of outsized volatility, apart from the medium-term objective of reducing dependence on imported crude.